Why today's cash rate announcement has economists in a whirl

For the first time since the arrival of Covid-19, interest rate cuts are a real possibility.

Mōrena, and welcome to The Bulletin for Wednesday, August 14.

In today’s edition: Our 30-year gene tech ban is set to end, a proposal to scale back Te Arawhiti has been revealed, and the Auckland City Mission finds methamphetamine in donated lollies. But first, all eyes are on the Reserve Bank. Will interest rates finally be cut?

Buckle in

Happy official cash rate day to all who celebrate. And maybe, just maybe, there will be some celebration today. Since 2020, there has been little to get excited about when it comes to the release of the OCR. And since May last year, there’s been very little to even talk about. Things have been in a holding pattern as the cost of living crisis raged on and inflation stayed high. In recent weeks, there have been murmurings that things are improving. At 2pm today, we’ll get the most black and white update on whether things are indeed different, as explained in detail by an excitable David Hargreaves in this piece for Interest. As he writes, while there’s every chance the cash rate could be kept steady once again, there’s also every chance it won’t. Things are in flux for the first time in months and that has economists (and some newsletter editors) excited. So what could we see today, and why does it matter?

Predictions, please

Forecasts around the OCR are, said BusinessDesk’s Dileepa Fonseka on Nine to Noon yesterday, a bit of a fool’s game. Nevertheless, let’s look at what has been predicted. Banks are mixed on whether we’ll actually see a cut today, reported 1News’ Anna Murray. Of the big banks, ASB and BNZ are tentatively picking a drop, while ANZ – often the most outspoken in its predictions – and Westpac have picked things will stay steady. Kiwibank’s economists have hedged their bets, predicting the Reserve Bank will hold the line but arguing that a cut would be the right move. One bank, TSB, has jumped the gun and preemptively cut its advertised home loan rates. Whatever happens today, the Reserve Bank will also lay out its plans for future OCR decisions.

There’s also mixed opinion from the shadow board of the NZ Institute of Economic Research, with over half arguing for a cut and the rest urging no change, while RNZ’s Nona Pelletier, from whom I have learnt pretty much everything I know about the economy thanks to her Checkpoint slots, reported that some high profile business leaders are also anticipating a cut today (or at least this side of Christmas).

Why some are expecting fireworks

The uncertainty described above is part of why today’s 2pm announcement will be even more closely watched than usual. But some of that uncertainty – and why it may ultimately be pointless to try and make a prediction – lies with the Reserve Bank itself. In May, explained Interest’s David Hargreaves, the central bank signalled a rate hike could be on the cards this year with cuts not expected until 2025, before quickly (and dovishly) pivoting to tease imminent cuts just a couple of months later. It all points to a close call today, though some, like Squirrel’s David Cunningham, have argued that kind of forecast flip flopping is unhelpful.

A lot has changed over the course of 2024, with the results of a business survey last month being interpreted by some that inflation – the main trigger for high interest rates – had been beaten. In that interview with Nine to Noon, Dileepa Fonseka noted recent comments from Treasury’s chief economist that interest rates are not a problem to be solved, they’re solving a problem: high inflation. The most recent data on that, as reported here RNZ’s Gyles Beckford, was that annual inflation had dropped to its lowest rate in three years. At 3.3%, it’s just shy of where the Reserve Bank is aiming for. Then there’s growing (though not quite surging) unemployment, a sign that the economy is at risk of bursting under restrictive conditions, and an increasing number of people leaving the country for good (as we talked about earlier in the year).

It’s been a long time between drinks

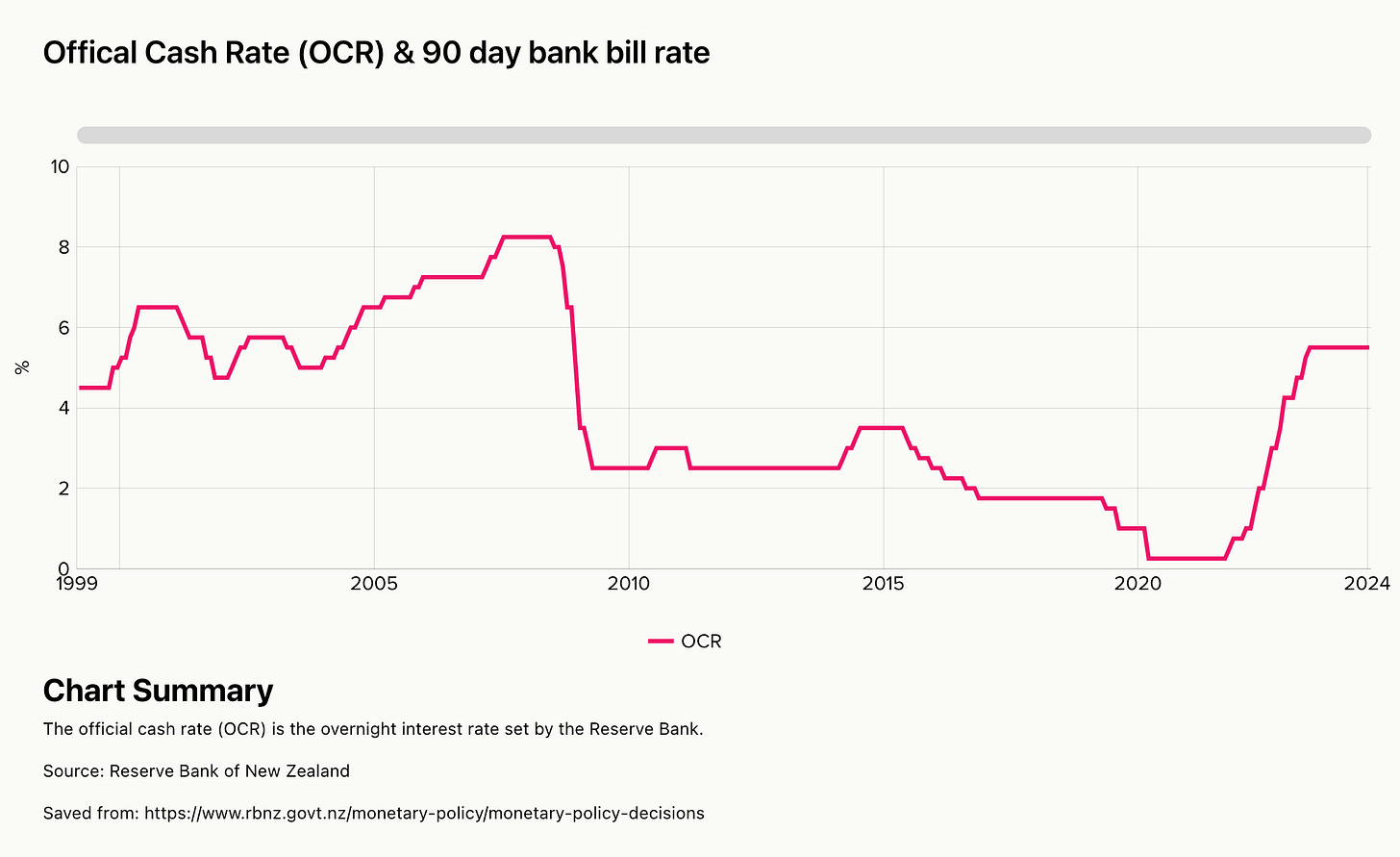

As mentioned, the last time the official cash rate changed was in May last year, as the graph below shows. That followed a series of hikes dating back to the depths of the Covid-19 pandemic. If you jump back before the unprecedented Covid dip, it’s been about five years since the official cash rate was sitting anywhere in the healthy zone. Not everyone will be celebrating, reported RNZ’s Susan Edmonds. If you’ve got money in a term deposit that you’ve been watching go up and up, expect your returns to fall as interest rates peel back.

There’s a political angle to consider here as well. For the government, a cut today would be most welcome. Off the back of its key election promise of tax cuts coming into force just a fortnight ago, any signs that the economy is on the up will be claimed as a victory for the coalition. The Post’s Luke Malpass writes that the tax cut scheme will have been the “subject of close scrutiny” by the Reserve Bank. The finance minister Nicola Willis has preemptively painted a fairly grim outlook for the economy, which could make any signs of improvement feel just that little bit better. Get out your popcorn, we’ll have all our answers at 2pm.

Show your support, join up today!

"As a New Zealander living in Sydney, The Spinoff helps me to feel in touch with what's happening back home. There's a great breadth to the content – and the enthusiasm from your contributors is palpable. I feel happy and proud to be a member." Ian, Sydney.

Whether living here or abroad, if you value our work please show your support by becoming a member today.

‘A major milestone’: Gene tech ban to be ditched

A near 30-year ban on gene technology outside the lab will be ended by the coalition government, it was confirmed yesterday. As the Herald’s Jamie Morton explained, the new law will be introduced later in the year and will see New Zealand aligned with Australia. A new regulator, within the Environmental Protection Authority, will also be established to oversee applications. Science minister Judith Collins called the move a “milestone” and said it would lead to improved health outcomes, climate change adaptation and deliver economic gains. But some, like the Green Party, remain worried, reported RNZ’s Craig McCulloch. “We'd be concerned if it became a laissez-faire regime, it'd risk our current GE-free advantage,” said the party’s biotech spokesperson Steve Abel. Labour has cautiously reacted to the news and said it wanted to see legislation first.

The subject of GE tech has been controversial and slow-moving here in New Zealand, as one scientist told RNZ’s Checkpoint yesterday. In Morton’s explainer, he reflects back on the “corngate” scandal from two decades ago. If you want an excellent reminder of that, and an extraordinary moment from our media history, here’s Duncan Greive’s report from a couple of years back.

We’ll have a detailed explainer of the GE issue up on The Spinoff later this morning, so swing back around later and read that.

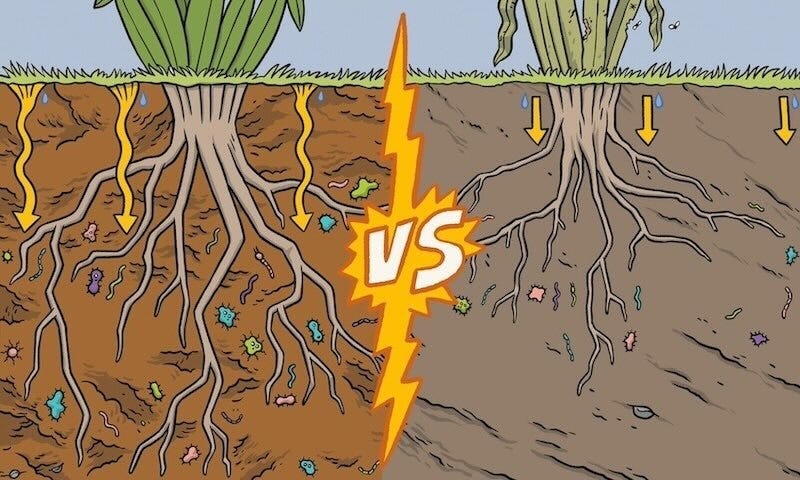

What the heck is regenerative agriculture? The latest climate buzzword, explained

Regenerative agriculture (regen ag, for short) is the next big food trend. It’s got grassroots popularity with farmers. It’s percolating through the food industry. And now consumers – in New Zealand and overseas – are cottoning on too.

But what is regen ag, exactly? Science journalist Ellen Rykers looks at what's involved, and why it could be the answer to some of the thorniest issues facing our environmental, farming and food sectors. Read her explainer here. (sponsored)

Te Arawhiti to be scaled down

The Office for Māori-Crown Relations, or Te Arawhiti, will be scaled back with responsibilities picked up by the Ministry for Māori Development, Te Puni Kōkoiri. Minister Tama Potaka said the ministry would pick up responsibilities around the implementation of Treaty settlements and “advise on policy to support the acceleration of Māori economic development, continue to support the revitalisation of Māori language and culture, and support Māori social development including through a social investment lens”. In a fiery interview with RNZ’s Checkpoint last night, Potaka claimed that iwi leaders wanted “clarity” on what agency was responsible for what, but couldn’t name anyone who endorsed the move.

Watch: Takeout Kids returning for season two

Coming-of-age documentary series Takeout Kids returns next week for season two, centred on the lives of five young people growing up between the classroom, home and their parents’ shops. Episode one premieres Tuesday August 20 on The Spinoff.

Made with the support of NZ On Air.

Click and Collect

If you want to put New Zealand’s interest rates in context, Brianna McIlraith at Stuff looked at how we stack up compared to the rest of the world and it makes for some interesting reading.

A report comparing Auckland’s performance against 10 other cities reveals familiar problems. Mayor Wayne Brown says it’s worthless. Duncan Greive disagrees.

Always love an inside story told via the art of official information act requests. This morning, Georgina Campbell at the Herald goes behind the scramble to respond to Interislander’s Aratere ferry grounding in Picton.

A classic Nick Truebridge exclusive on ThreeNews last night: Oranga Tamariki has apologised for acting “well below expectations” after Auckland counselling provider had its contract cut at short notice.

For Newsroom Pro readers, a scene setter from Laura Walters of the prime minister’s third trip to Australia in eight months.

The world’s richest man interviewed the once most powerful man on Twitter last night (that’s Elon Musk and Donald Trump, by the way). This CNN analysis explains all you need to know if you didn’t spend two hours listening.

I made the mistake of leaving San Francisco 48 hours before Chappell Roan performed a festival set in the city. But as Chris Schulz of Boiler Room writes, it looks like the pop superstar could be heading to our shores in the new year (yes please).

Take part in The Spinoff survey for a chance to win one of three $400 Prezzy Cards!

Your feedback is crucial to us, and as an independent media company, we're committed to making your experience even better. The survey is quick, anonymous, and we’ll only use your email for the prize draw. Don’t miss out—click here to have your say and enter the draw!

Claire Mabey explains the allegations against author Neil Gaiman detailed in a new podcast. Max Reeves discusses how a “conservation at all costs” mindset obscures the stories of our neighbourhoods. The Spinoff Review of Books shares an excerpt from Talia Marshall's new book Whaea Blue. Anna Rawhiti-Connell dissects the rise and fall and rise and fall of Raygun, an internet sensation. For The Cost of Being, an Otago student who has been saving since school breaks down his costs.

That’s it for today, thanks for reading. I’ll see you back here tomorrow morning.

Let me know in the comments, or get in touch with me via email at thebulletin@thespinoff.co.nz, if you have any feedback on today’s top stories or anything in the news.

If you liked what you read today, share The Bulletin with friends, family and colleagues.