The sun peeks through the economic clouds, but when will it fully emerge?

The Reserve Bank followed through on a widely predicted double rates cut. It's just the beginning.

Mōrena, and welcome to The Bulletin for Thursday, October 10.

In today’s edition: Criticism over how the government funded Gumboot Friday, an emergency management overhaul is in the works, and $500,000 in political donations are associated with fast track projects. But first, the good, the bad and the ugly of the double whammy rates cut.

Victory in battle with inflation

The Reserve Bank has met expectations, opting yesterday afternoon to cut the official cash rate by 50 basis points instead of the typical 25. It brings the OCR down to 4.75%, explained RNZ, the lowest level since February last year. While there was no opportunity to hear directly from the Reserve Bank governor Adrian Orr, the Monetary Policy Committee said in a statement that it agreed the cut was “appropriate” in order to “achieve and maintain low and stable inflation, while seeking to avoid unnecessary instability in output, employment, interest rates, and the exchange rate”.

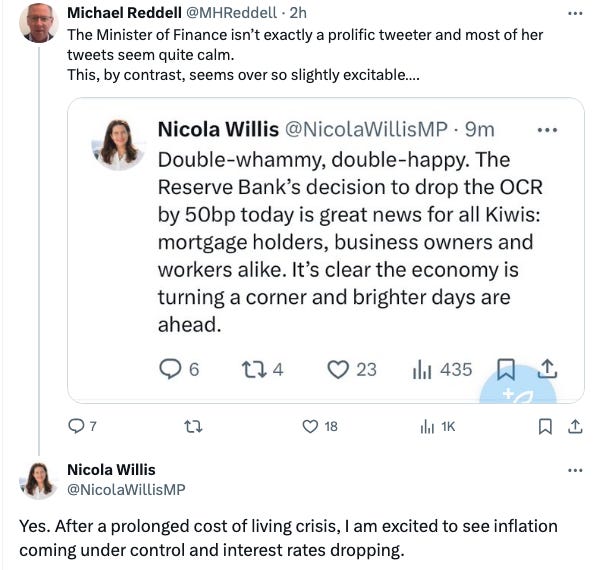

The decision was welcomed by the coalition government who, as is something of a tradition when it comes to positive economic news, took some of the credit. Speaking in Christchurch, finance minister Nicola Willis said the move was a “sign we’ve got inflation coming under control” and it would help boost confidence in the economy.

Rapid rates drop

The Reserve Bank’s double whammy cut wasn’t a surprise. Last month, the US Federal Reserve opted to make a similar “jumbo cut”, which BNZ’s chief economist Mike Jones said could put “more pressure” on our central bank to take a heftier axe to interest rates. By last week, there was a general consensus among leading economists that a 50 basis point cut was the right call (Kiwibank even pre-emptively slashed its rates in a “marketing” move) though some acknowledged that the Reserve Bank may opt for a more cautious option. The most recent business survey by the NZ Institute of Economic Research appeared to be the catalyst for this, with overall confidence improving but “continued softness in economic activity”.

Writing for Interest earlier in the week, David Hargreaves described Adrian Orr’s approach as being “shoot on sight”, meaning that if he believed the cash rate should be hurriedly dropped, “then dropped in a big hurry it will be”. That’s precisely what has happened – and we could see things ramp up from here.

The response from mortgage holders has been almost instantaneous, reported The Post, while the New Zealand sharemarket surged 1.75%.

‘Brighter days ahead’

Back in May, before announcing her first budget, finance minister Nicola Willis evoked Florence + the Machine when describing the state of the economy. “It's always darkest before the dawn,” she said, telling The Post’s Luke Malpass that “in all likelihood, the fiscals look worse next year than this year. And that's just the reality of bad growth”. By the time we got to September’s official cash rate cut, the forecast had improved. “It is cloudy, but rays of light are getting through," Willis said. Yesterday? “We are confident that brighter days are ahead.” In short, the government’s narrative appears to be that we are turning a corner when it comes to the cost of living crisis.

The Reserve Bank appears increasingly confident of that too, explained Interest’s Dan Brunskill. It believed that the forthcoming consumer price index release would show that annual inflation was comfortably within the 1-3% target range, and close to bang on 2%. In a follow up report, headlined “THE WAR IS OVER”, Brunskill declared that inflation had been “defeated”.

A dose of realism

So when might the sun, to borrow Willis’s weather metaphors, finally break through? Writing for the Herald (paywalled), Liam Dann explained that while yesterday’s announcement was already great news for borrowers (homeowners in particular), further cuts are likely. It’s widely pegged the Reserve Bank will slash a further 50 basis points off the official cash rate before the end of the year, as BusinessDesk’s Rebecca Howard (paywalled) explained. Some predict another double cut in early 2025, while Infometrics economist Brad Olsen said there was “real potential” for a 75 point cut this side of Christmas.

But throwing in a healthy dose of realism, Dann noted that while we can celebrate the end of the inflation battle, “we need to pinch ourselves and remember that central banks don’t deliver outsized cuts to interest rates unless the economy is in very bad shape”. Rising unemployment is one concern, while economist Craig Renney told the NBR (paywalled) that low income New Zealanders who rent “might not feel the benefits of an interest rate cut”.

Associate finance minister, and Act leader, David Seymour had similar critiques on the broader state of the economy and was quick to blame the Reserve Bank for the mess that he claimed was now being cleaned up. “A 50 basis-point cut is a multi-billion dollar mea culpa [on the Reserve Bank’s part],” Seymour said in a statement. “And the latest twist of a nauseating three-year fiscal and monetary roller coaster.”

Join our community of supporters

"I like that it feels like chipping in for a good cause, rather than paying for a subscription." – Kimberley, Spinoff member.

Whether you read, listen to or watch our mahi, you can support us to do more by donating today or signing up to become a member. Already a member? Ka nui te mihi, your support means the world to us.

‘Inconsistent and unusual’ funding process for Gumboot Friday criticised

A government watchdog has criticised how the coalition went about providing $24m to mental health charity Gumboot Friday, reported Stuff’s Bridie Witton. Auditor-general John Ryan informed the Ministry of Health yesterday that he had concerns with how the contract was awarded, claiming that the Mike King-led charity was selected “without an open and transparent process to assess which type of service would best meet the policy objective, which providers might be able to deliver that service, and the appropriate amount to pay”.

We’ve talked about some of these concerns around procurement in The Bulletin before, given they predate the coalition’s decision to fund Gumboot Friday. However, while the former Labour government also awarded funding to the charity, the coalition went significantly further. In his letter, the auditor-general also said there was "no opportunity for a fair, open, or competitive procurement process" and that the funding was to a specific supplier, rather than for a "broad policy initiative" or to achieve a specific policy outcome.

Emergency management overhaul in the works

The government has confirmed this morning it will overhaul New Zealand’s emergency management system. RNZ’s Hawke’s Bay based Alexa Cook explained that all 14 recommendations made in an inquiry into last year’s devastating weather events would be actioned, with five broad areas to be targeted. It includes giving effect to the “whole‑of‑society approach” to emergency management and supporting local government to deliver a consistent minimum standard of emergency management across New Zealand.

There have been multiple reviews into emergency management systems in the wake of the Auckland Anniversary Weekend floods and Cyclone Gabrielle, but it’s the overarching inquiry headed by former governor-general Jerry Mateparae that the government has opted to tackle head on. Emergency management minister Mark Mitchell acknowledged there was no quick fix. “The emergency management system is inherently complex," he said. “Early next year, I will publish a public roadmap, giving clear direction and timelines for the next phase of this work so that you can hold us to account for delivery.”

Join us for a one-night only live event

We’re huge fans of local television here at The Spinoff, and for one night only we want to celebrate some of our all-time faves. Join Alex Casey, Kura Forrester, Rhiannon McCall, Stewart Sowman-Lund and Lyric Waiwiri-Smith at Q Theatre on October 31 as we unearth some beloved TV gems and argue for their place in our history.

Click and Collect

Max Rashbrooke for The Spinoff questions whether the slow drift towards “user pays” risks turning New Zealand into a two-tier society.

More excellent fast track analysis from RNZ’s Farah Hancock, who reveals that companies and shareholders associated with 12 proposed projects gave more than $500,000 in political donations to National, Act and New Zealand First. Meanwhile, a new episode of The Detail podcast asks whether the 149 proposed fast track projects are a “to do” list, or a wish list?

Casey Costello’s claims a stubborn group of “hardcore” smokers would use heated tobacco products to kick the habit are not backed up by evidence.

For Newsroom Pro subscribers, Laura Walters reveals the Koroneihana speech the prime minister didn’t give (this story also includes an email written in Christopher Luxon’s now infamous typeface choice: blue comic sans). (paywalled)

Meanwhile, Christopher Luxon maintains the East Asia Summit is still relevant as he touches down in Laos.

Andrea Vance at The Post explains why today’s “do-or-die vote” on the sale of shares in the international airport is a simple decision that has become horribly complicated.

Liam Rātana writes about the fight for the toheroa of Te Oneroa-a-Tōhe. Tara Ward power ranks week five of Celebrity Treasure Island. I review the new Joker film and explain why it’s maybe not quite as bad as others have claimed. Toby Manhire reimagines the Tour of New Zealand board game as a trip around the proposed fast track projects. Lyric Waiwiri-Smith watches the new John Campbell docuseries that gives a taste of TVNZ’s new era. A bunch of Spinoff writers give their quickfire reckons on the Laneway 2025 lineup. Hera Lindsay Bird denounces our new “ersatz, pretender” moon.

That’s it for this morning, thanks for reading. I’ll catch you back tomorrow.

Want to get in touch? Join the conversation in the Substack comments section or via email at thebulletin@thespinoff.co.nz if you have any feedback on today’s top stories (or anything else in the news).

If you liked what you read today, share The Bulletin with friends, family and colleagues.

I'd really love to see a column on the idea that the Reserve Bank is not fit for purpose. That giving the Reserve Bank only one lever to pull to control inflation, interest rates, is predicated on the fallacy that all inflation is caused by excessive consumption, with interest rates used to reduce consumption. That the last burst of inflation we saw was not caused by excessive consumption, but instead a combination of profit taking by national and international firms, and external events such as the Ukraine war. That the last lot interest rate rises from the Reserve Bank mainly served to hurt the economy, ruin businesses, and impoverish people.

I think several things have clearly happened. 1 Grant Robertson and Jacinda Adern had a tight fiscal watch as the primary concern had to be well being in face of Covid. 2 The improving trends were clear in 2022 and there was no doubt we were near the top of nations succeeding and trending positively. Never lost triple Gold Star economic rating. 3 The trends internationally are improving which have strongly benefitted us. This is continuing and we benefit. 4 Austerity fantasies and impositions and running down the public service while hand out tax benefits to the entitled most undeserving while putting more people out of work does not get the settings right long term.

By the time people realise just how stupid Nicola’s obsession with reducing any and all spending they will have “served their time and the country will need life support.

The “Whata Ora” or Health Department is a very special case. The balance is to meet the financial requirements. Have super dedicated efficient hard working dedicated staff - as we have in New Zealand. Cover the costs and make up gaps. Don’t set artificial upper levels to budget’s but have strong tight and passionate managers who know healt systems through and through!