The perverse bad news that is low unemployment

The unemployment rate will be announced today. It’s expected to be low and the message that we'll need to swallow the bitter pill of increased unemployment is ramping up

Mōrena and welcome to The Bulletin for Wednesday, November 2, by Anna Rawhiti-Connell. Presented in partnership with Z Energy.

In today’s edition: dozens of communities at serious risk of flooding; Ruapehu ski fields get $4m rescue package; Olympians to throw rocks; but first, the message that unemployment will need to rise ramps up

The message that we'll need to swallow the bitter pill of increased unemployment is ramping up (Image: Pexels)

“A wet weekend’s bit of work”

That’s how Bill Phillips, the New Zealand economist after whom the Phillips curve is named, described his theory. It’s now economic orthodoxy. The curve hypothesised a correlation between reduction in unemployment and increased rates of wage rises. I was driven to it after comments by Cameron Bagrie yesterday about unemployment needing to go up in order for inflation to come down. He’s not the first to say it and it won't be the last time we hear it. Bagrie’s segment was headlined “Economist Cameron Bagrie warns Kiwis need to lose jobs to get inflation under control”. That’s emotive framing or about as blunt as you can get, but the comments are essentially the same as those made by Reserve Bank governor, Adrian Orr last week.

The fairness of what we’re being told is necessary

It sounds perverse, not least of all because we’ve been talking about labour shortages all year. Every time jobless numbers hit the media, it sets off talkback calls about the “lazy, who just don't want to work”. Meanwhile, minister for social development Carmel Sepuloni has asked MSD to prepare for higher unemployment next year. It’s not the job of economists to sugar coat things, but you wonder if economists can hear themselves sometimes when what they’re essentially saying is that people will need to suffer to tame a beast that isn't really of their own making. Bernard Hickey has questioned the fairness of the prescription of this bitter pill, in light of those who benefitted from the loosening of monetary policy in 2020 and 2021 and those who did not.

Unemployment and wage data out today

The unemployment rate is expected to remain low. Again, perversely, this will be bad news. Finance minister Grant Robertson will no doubt front after the data is released. When last asked about the cost of living a couple of weeks ago, Robertson essentially said people will be supported through tough times but admitted those already struggling were unlikely to get a 7.2% increase in benefit or pension payments to match inflation. I do wonder whether all this talk of unemployment as necessary medicine might bolster support for the income insurance scheme. Good piece from Stuff’s Thomas Manch here on how vulnerable that, and some of Labour’s other “legacy” policies are right now.

Is Robert MacCulloch still waiting for a call?

Unemployment as a necessary trade-off to tame inflation is a global conversation. Unlike the bad medicine Bon Jovi said he needed, people are not only questioning whether it's fair or necessary but whether the cure is worse than the disease. This new piece from The Verge breaks down the double whammy of high inflation and high unemployment on low income families. L.A. Times columnist Michael Hiltzik cites labour economists who dispute the idea that higher wages drive inflation. Stuff’s Susan Edmunds looked at the impact of rising inflation and tax bracket creep on real wages yesterday. In hindsight, maybe we went too early (July) with this piece from our business newsletter editor, Chris Schulz, on research that showed high unemployment was worse for people’s well being than high inflation. I wonder if the researcher, Robert MacCulloch, is still waiting for his call from the Reserve Bank.

It could pay to have your say

Got thoughts about where Aotearoa’s headed? Join Stuff’s research community and you’ll have the opportunity not only to answer questions about the state of things, but also to win regular prizes – all participants go into the draw to win up to $1,000 in Prezzie Cards every 3 months, with over 30 winners per draw. To learn more about the project and to join the community, click here. (Sponsored)

Government and Reserve Bank report highlight serious risk of flooding

A new government report has identified 44 communities across 12 regions in New Zealand that are at serious risk of flooding and are totally unprepared for it. Associate minister for local government, Kieran McAnulty said the reality was most areas of New Zealand were at risk of severe weather events. McAnulty cited the floods in Marlborough in July 2021 saying the government had kicked in 95% of the $85m cost to repair damaged roads and indicated that wasn’t going to be a sustainable approach. Preliminary climate-related "stress-testing" done as part of a wider report that will be released by the Reserve Bank today, has found that in one severe scenario, a quarter of surveyed banks' current Auckland mortgage lending was on land that could be hit by river or surface flooding. In weather news, the West Coast is bracing for half a metre of rain in 24 hours.

Ski field gets lifeline

As RNZ’s Katie Todd reports, ski field operator Ruapehu Alpine Lifts (RAL) has received a $4 million rescue package. The government and ANZ will provide emergency funding to get RAL through to Christmas. Just last month minister for economic and regional development, Stuart Nash ruled out further government bank loans for RAL. Nash said cabinet had given a mandate to the Ministry of Business, Innovation and Employment provincial development unit to lead negotiations with ANZ and others to endeavour to support the continued operation of the ski field.

Journalism is an essential part of society and shouldn’t be a privilege of those who can afford it. The support of readers like yourself helps to ensure The Spinoff remains freely accessible to all, regardless of their ability to pay. If you value what we do and have the means to do so, please make a donation today.

Click and collect

Council of Trade Unions versus the National party on cost and beneficiares of National’s tax plan

Phenomenal account of the first meeting of the new Auckland Council from Todd Niall

Good Claire Trevett column (paywalled) on Christopher Luxon’s byelection candidate diversity call - “perilously close to Labour’s 2013 man ban”

Throwback to a piece from Labour’s Hamilton West candidate Georgie Dansey from our 2020 election “Last on the List” series

The “Costco effect” for New Zealand businesses

Got some feedback about The Bulletin, or anything in the news? Get in touch with me at thebulletin@thespinoff.co.nz.

If you liked what you read today, share The Bulletin with friends, family and colleagues.

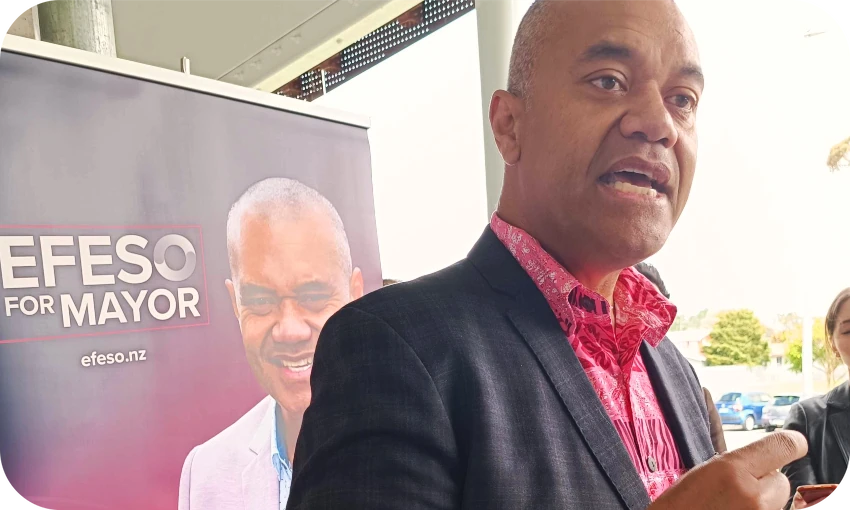

Toby Manhire watches as Efeso Collins speaks for the first time since the election about the "biggest challenge" identified by researchers commissioned by his campaign: "the colour of his skin". Bernard Hickey analyses the latest Three Waters developments as the government barrel straight past a potential offramp. Stewart Sowman-Lund charts how the relationship between The Caker and Chrissy Teigen went from collaboration to accusations of copying within a matter of months. Catherine McGregor reviews one of the TV shows of the year, which has seemingly arrived on TVNZ+ out of nowhere. Emily Writes has everything you need to know about the latest niche drama engulfing the internet, involving celebrity emus and an outbreak of avian influenza.

Olympians to throw rocks

The South Canterbury Amateur Athletics Club is getting out the rocks and the yardsticks for an event this weekend to celebrate its 150th birthday. The club will be staging an athletics meet based on how things were done when it was founded in 1871. The club's current Olympians Tom Walsh and Lauren Bruce will be there throwing rocks. Skill will be undoubtedly required but it also sounds slightly therapeutic. Delightful story.

A film about Dr Siouxsie Wiles is close to being finished but needs a final boost

In March 2020, filmmaker Gwen Isaacs began documenting Dr Siouxsie Wiles as she stepped into the public eye and worked to inform New Zealanders during the tense early months (and beyond) of the Covid pandemic. Wiles has been a valued contributor and friend of The Spinoff for half a decade, and her work with Toby Morris on public health communications was unmatched. The documentary about her life over the past three years is nearly finished, with a Boosted campaign fundraising for final post production costs. If you’d like to support the film, you can do so here.

Employment and inflation links are based on economic orthodoxy of the mid 20th century prior to globalisation and the destruction of labour power. The main driver of inflation in the new world order of globalisation is margin growth through monopolistic behaviours of an increasingly monopolistic controlled supply chain. Higher interest rates are not the solution; rather super taxes on monopolistic margins. A super tax on excess margin.

Re Inflation & unemployment.

I'm travelling around flooded Victoria, Australia and haven't commented for a while!!

I love your commentaries and other re kiwi life.

Re inflation and unemployment - the Phillips curve et al were lost in the dust many years ago.

An issue with this inflationary period is that it is a "Profit Driven Inflation".

If profits are not dealt with then the inflationary moment will be an ongoing problem.

If it was an employment driven inflation then of course tinkering around with un/employment may affect the process.

I can discuss further but your eyes would glaze over and the thinking processes slow down.

"Profit driven inflationary period"