The cases for and against forgiving student loan debt

Following US president Joe Biden’s announcement about forgiving student debt, the debate about doing the same in New Zealand has fired up again

In today’s edition: tool launched to help you navigate the local government elections; new tax to be introduced for Kiwisaver funds; inflation to stay high until end of 2023; but first, to forgive or not to forgive, that is the question.

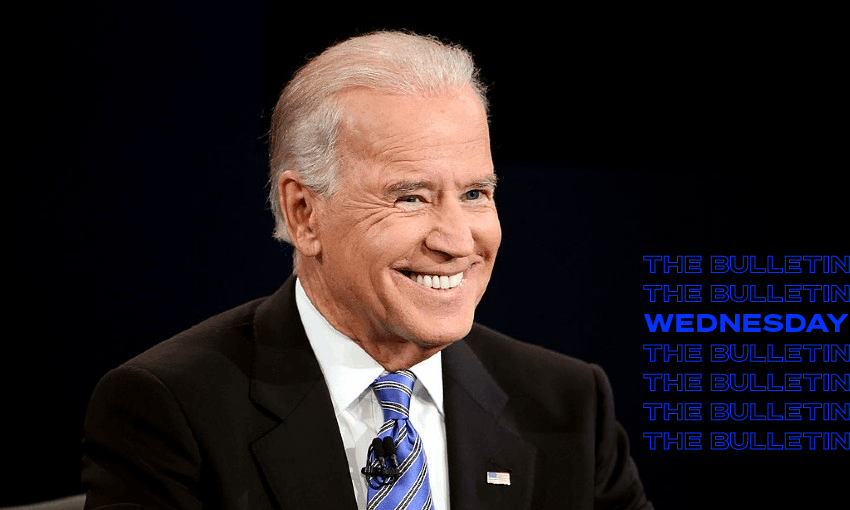

US president Joe Biden has announced that billions of dollars of student loans will be cancelled. (Getty Images/Chip Somodevilla)

US announcement restarts debate in New Zealand

US president Joe Biden announced last week that he was cancelling billions of dollars of student loans. Naturally it has also reinvigorated debate about whether New Zealand should follow suit. I also imagine nurses and midwives are looking to Australia with envy as their counterparts in Victoria will now have their university fees paid off by the Victorian government. I don’t think this is currently a live political issue for the main parties, although the Greens campaigned on some student loan policy change in 2020. We seem to have just accepted student loans as a given.

Student loan impact on ability to get home loan

As evidence points to life being financially horrible for Gen Z and millennials, perhaps it should be something we discuss more. I was always told that your student loan didn't matter when it came to getting a home loan. Terrible advice. I asked David Cunningham, CEO of mortgage broker Squirrel about this yesterday. He said anyone looking to maximise their ability to borrow will be hampered by their student loans, but hopefully their income is higher from having a qualification. I also asked about the impact of recent interest rate rises. Cunningham said the “assessment rate” of 7.5% to 8% all banks use to assess affordability on a loan aren’t impacted by the student loan per se, but because the assessment rates have risen, that reduces the amount a customer can borrow. Your student loan repayments are also considered an expense.

Rather see nurses get a pay rise than wipe student debt

Speaking to Stuff’s Rob Stock about whether we should follow in the US’s footsteps, economist Brad Olsen doesn’t see a need to. He’d rather see nurses get a pay rise. The NZ Initiative has recently said interest should be reintroduced on new student loans, arguing that it would free up money for students who have a greater need for financial support. Jack Tame doesn’t think tertiary education should be free as education is an investment for an individual. As a case for free tertiary education, chief justice Dame Helen Winklemann’s comments in 2019 about the relationship between the socio-economic diversity among New Zealand’s current crop of judges and free education in the 70s and 80s, have stuck with me.

Student loan forgiveness as compensation for unfairness of GST

The Bay of Plenty Times’ Jo Raphael (paywalled) writes that having student debt impacts major life decisions including whether or not you should have children or stay in New Zealand. Spokesperson for Child Poverty Action group Susan St John has just written a very critical assessment of our current tax system saying an overhaul of our low-rate broad-base tax system would go a long way to addressing our huge wealth gap. St John’s argument is centred around the unfairness of GST and she suggests that student loan forgiveness is one way to compensate for that unfairness among low-income adults without children.“These must not be viewed as handouts, but recognised as the price to be paid for our simple but regressive tax system.”

The Spinoff Members is a community dedicated to supporting quality, homegrown journalism.

From our newsletters and podcasts, to our coverage of te ao Māori and political reporting – the support of readers like you makes this work possible and helps to ensure it remains freely available to all. If you can, please consider making a contribution today.

The best policy tool in town is back

Throwing back to the lead in yesterday’s Bulletin about board of trustee elections, some non-partisan and accessible information about the upcoming local government elections feels more important than ever. Good news then because Policy.nz, partnering with The Spinoff, is here to help. Enter your address at Policy.nz and you’ll see which elections you get to vote in, with the rival candidates’ pitches side by side. As Toby Manhire writes this morning, “the lack of competition for seats across most of the country is mirrored in a lack of voter turnout. That creates a vulnerability, which – as won’t have escaped your notice already – some are looking to exploit. More than ever, then, it’s critical (a) to vote, and (b) to have the facts in front of you when you do.”

Government will net additional $225m a year by lifting GST on Kiwisaver fund fees

“Tax Grab” is running as the frontpage headline for the Herald today. As Thomas Coughlan and Tamsyn Parker write, the government has “quietly” introduced a tax on Kiwisaver by planning to levy GST on Kiwisaver and managed fund fees. The new rules will net the government an additional $225m in tax each year. Stuff’s Tom Pullar-Strecker writes that a regulatory impact statement prepared for the government warned that Kiwisaver providers might pass on the full extra 15% to members, rather than cutting their own fees to accommodate it. Modelling from the Financial Markets Authority warns the tax and its compounding effects will dent Kiwisaver balances by $103 billion by 2070.

House prices half way through fall, inflation peaked but it could be 2024 before it falls

New economic forecasts have dropped this morning from ASB economists. Grit your teeth and gird your loins for another year. ASB says New Zealand is probably just over halfway through one of the biggest drops in nominal house prices that the country has ever seen. ASB expects a 12% drop in house prices, which would be equivalent to 20% when adjusted for inflation. The bank also predicts the OCR to peak at 4% by the end of next year and then drop in 2024. Chief economist Nick Tuffley said inflation had already peaked but it could be 2024 before it dropped below 3% again. Here’s Bernard Hickey with a reminder that a 20% drop in home equity is probably ok and you don’t need to panic.

Click and collect

Uber and Airbnb will need to levy GST on fares and bookings under proposed law.

Covid traffic light settings will be reviewed in a fortnight - here’s a few points of view on potential move to green.

Turns out the diamonds painted on roads function purely as a warning.

Plot thickens in Wellington mayoral candidate hoarding drama.

Guilty verdict for Chris Dawson in Teacher’s Pet trial.

Got some feedback about The Bulletin, or anything in the news? Get in touch with me at thebulletin@thespinoff.co.nz.

If you liked what you read today, share The Bulletin with friends, family and colleagues.

Humans – and all the species we share a planet with – evolved for total darkness at night, but over the last century or so our urban areas have become increasingly flooded with artificial light. Shanti Mathias talks to the scientists, doctors and stargazers who are making a case to preserve darkness. Reweti Kohere visits social enterprise Will & Able, which wants to create 100 jobs for disabled New Zealanders, and talks to three employees about what the chance to work means to them. Te Kuru o te Marama Dewes reports on an unusual agreement between police and Tainui in Cambridge. Tara Ward interviews Lucy Lawless as the new season My Life Is Murder arrives on TVNZ+. Sam Brooks reviews bestselling novel Tomorrow, and Tomorrow, and Tomorrow, and finds it's actually... so yesterday.

Why All Blacks fans should keep melting down

Pretty good Kris Shannon column (paywalled) on the Herald this morning on the five reasons why All Blacks fans should keep melting down about the team’s current losing streak. I admit to seeing the headline and howling “when will it end?” but then I read it and I laughed. He also makes a fair point about the absence of emotion being detrimental to the sporting experience in this country. Healthy perspective from a passionate fan.

“I never got drunk or danced in public through that whole ten years”

Feature listen for today from The Detail. With recent events surrounding backbench MPs, The Detail spoke to two former backbench MPs Sue Bradford and Lawrence Yule about what it was like for them. I know we don’t like to think of MPs as humans but these two remind us that MPs are. They both talk about the advice they got, the importance of knowing why you’re in parliament, accepting you may never get further than being a backbencher, treating your staff well and remaining humble.