Growing number of homeowners falling behind on their mortgage

Banks are seeing a big rise in mortgage arrears, and some analysts believe it could force the Reserve Bank to rethink its position on interest rate cuts – just not this week.

Mōrena, and welcome to The Bulletin for Monday, April 8, written by Catherine McGregor.

In today’s edition: Kāinga Ora name change will be legally tricky; English language and work skills added to immigration rules; Heavy rain to hit much of the country this week. But first, the Reserve Bank said it wouldn’t cut rates until 2025. Will the rise of severe mortgage stress end up changing its tune?

Mortgage hardship on the rise

Increasing redundancies, inflated interest rates and a stubbornly high cost of living have all contributed to a growing number of homeowners struggling to pay their mortgage. A total of 22,600 mortgage accounts were past due in February, according to credit bureau Centrix, up by 800 from the previous month and an 18% increase year-on-year. The mortgage data is part of a mixed picture for the credit-lending sector, the report shows. While the number of credit accounts in arrears dropped slightly between January and February, the level of financial hardship is going up. Year-on-year, the number of accounts in financial hardship was up by 27%, and 44% of hardships now relate to "mortgage payment difficulties", reports 1 News. Mortgage holders struggling to keep up have some hard decisions to make. One budgeting advisor tells the Herald she’s seeing more homeowners foregoing home insurance, which puts them in breach of their loan agreement. “They’re saying, ‘well our mortgage is slightly more important than the insurance that we’re paying for our house’,” she says. “It’s just coming back to that lack of cash.”

North Island loan-holders suffering most

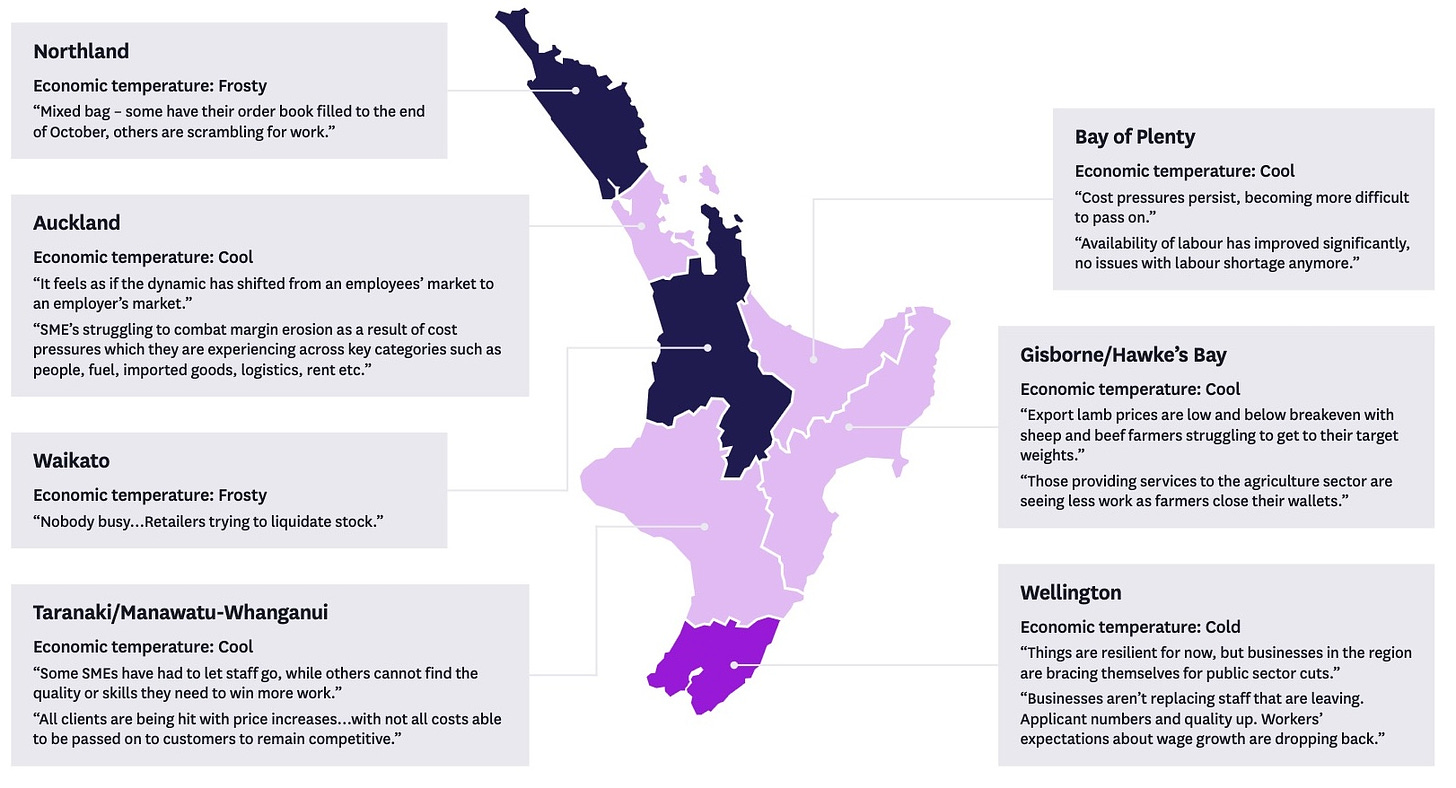

The Centrix report throws up some compelling data on which areas of the country are financially hurting the most. “The top 10 regions for loan arrears [of any kind] are in the North Island, with nearly one in five people in the Kawerau, Wairoa and South Waikato districts behind on at least one credit contract,” reports The Post’s Rob Stock (paywalled). While Wellingtonians experienced minimal credit pain so far, many are expecting their situation to change as public service redundancies take effect. Consumer confidence is down everywhere, but it’s dropped the most in Wellington, Westpac’s regional confidence survey finds. The same survey’s “weather report”, based on feedback from staff in the field, also shows an economic gap between the North and South Islands. Large parts of the North Island report “frosty” and “cold” economic conditions, while most of the South Island is only “cool”.

Financial stress may prompt RBNZ to act sooner

While the vast majority of mortgage holders aren’t in arrears, that doesn’t mean they aren’t under intense home loan stress. As homeowners continue to roll off lower fixed rates, the financial pain is being felt more and more broadly, impacting the Reserve Bank’s (RBNZ) plans for interest rate cuts, says Interest’s Dan Brunskill. Although RBNZ has publicly stated it doesn’t plan to cut until next year, “most economists and traders expect the economy to buckle before then and force earlier cuts,” he writes. Just don’t expect any change on Wednesday, when RBNZ’s monetary policy statement is released – commentators are agreed the official cash rate is staying at 5.5% for now. RBNZ’s expectation of monetary policy staying put for the rest of the year “seems premised on a relatively benign outlook for financial stress”, UBS economist Nic Guesnon tells Brunskill. However he thinks May’s Financial Stability Report is likely to paint a very different picture, given the upwards trend in loan arrears. That could be enough to prompt a change of tone from the Reserve Bank.

Why can’t NZ get business regulation right?

The announcement that the rules on building product standards are to be loosened has helped bring the high cost of life in New Zealand back into the headlines. Writing in The Post (paywalled), Simplicity’s Sam Stubbs says poor regulation – either too much or too little – is one of the biggest reasons that everything is so expensive here. On the “too little” side is the light-handed regulation of business, which allowed the “development of oligopoly and cartel-like behaviours in areas like banking, supermarkets and petrol”. In other ways, including building standards and resource consents, NZ is a highly over-regulated environment, he writes. “Just try setting up a school fair or farmers’ market in a public park to see just how silly many regulations are.”

Join The Spinoff members, now with comments

Spinoff members can now comment on a selection of stories. It’s just one of the benefits of being a Spinoff supporter.

This morning you can:

Tell us whether you agree with our reviewer’s verdict on the docudrama Mr Bates vs the Post Office.

Read the bigwigs’ take on what’s ailing NZ media, and chime in with your own diagnosis.

Share your thoughts on a wryly funny essay about the best way to cure depression (it’s easy when you know how!).

Log in, let us know what you think, and as always, we’d be grateful if you’d consider becoming a Spinoff supporter if you’re not already.

See you in the comments section,

Madeleine Chapman

Editor

Kāinga Ora name change will be legally tricky

The government may want to refer to Kāinga Ora by its English name, but it’s going to be a challenge to make a name change official, writes Tova O’Brien this morning. According to legal advice released to Stuff under the OIA, the agency’s name is legally Māori-first, as entrenched in its establishing legislation, and while it could use “Housing and Communities” as a ‘trading name’ in general communications “it must use its legal name in formal documents such as contracts”. Of 11 entities and departments identified by Stuff as definitely falling under the National/NZ First agreement on the use of English, two – Waka Kotahi and Te Whatu Ora – have made significant changes to their branding, despite not yet having been directed to change their names. Rau Paenga, the Crown infrastructure delivery agency, has also commissioned an alternative English-first logo “just in case it was needed”, despite the fact the Crown company is not officially covered by the coalition agreement.

English language and work skills added to immigration rules

The government is changing the rules of the accredited employer work visa scheme in a bid to address the “unsustainable” surge in migration over the past year. Low-skill workers will need to prove an ability in English and be subject to work experience or qualifications requirements, and most will have their maximum continuous stay reduced from five years to three. A number of roles in construction and other trades that were going to be added to the green-light list will now no longer be on it, and the franchisee accreditation category has been disestablished. The changes take immediate effect. "The government is focused on attracting and retaining the highly skilled migrants such as secondary teachers, where there is a skill shortage,” said immigration minister Erica Stanford. At the same time we need to ensure that New Zealanders are put to the front of the line for jobs where there are no skills shortages."

A conversation with Grant Robertson at the cricket

In a special edition of Gone By Lunchtime, the former finance minister and soon-to-be vice-chancellor at the University of Otago chats with Toby Manhire from the nosebleeds at the Basin Reserve. On the agenda: tax reforms lost, the Covid legacy, the lure of Dunedin, and which White Fern Robertson most identifies with.

Click and Collect

‘Warning’ levels of rain could hit the west and north of the South Island and central parts of the North Island this week.

An independent panel will be appointed to review NZ’s 2050 methane target, the government has announced.

A Christchurch street and a park associated with historic child abuse are likely to have their names changed.

Te Papa level five, which houses part of its art collection, is to close for at least nine months for repairs.

The Christ Church Cathedral restoration is $114m short and will be mothballed indefinitely unless $30m can be found by August.

Feeling clever? Click here to play 1Q, Aotearoa’s newest, shortest daily quiz.

In light of the collapse of Newshub and job losses at TVNZ, Duncan Greive asks the people in charge what if anything can be done to rescue NZ media. Joel MacManus presents an operationalised, strategically aligned, actionable guide to the phraseology of Prime Minister Christopher Luxon. YA author David Hill remembers the school essay that set him on the path to becoming a writer. Kristin Kelly shares some handy tips for curing your own depression. Toby Manhire spends the day at the cricket with Grant Robertson.

Sporting snippets

Billy Guyton, the late rugby player who received a post-mortem CTE diagnosis, was told “to leave your sh*t at home” when he went to Blues management for help, his family claim.

New Zealand won both the men’s and women’s titles at the Hong Kong Sevens.

The NZ Football Ferns beat Thailand 4-0 in Christchurch on Sunday.

The Bulletin is looking for a sponsor

Expertly curated, The Bulletin delivers essential news and diverse perspectives from Aotearoa and beyond to business leaders, politicians, and decision-makers nationwide. Contact commercial@thespinoff.co.nz to learn more.

Got some feedback about The Bulletin, or anything in the news? Get in touch with me at thebulletin@thespinoff.co.nz.

If you liked what you read today, share The Bulletin with friends, family and colleagues.

The tax cuts for landlords should have gone to first home buyers!

This will create a landslide of property values dropping through the floor.