A new social welfare net for New Zealanders

The government’s proposed unemployment insurance programme would also cover people with health conditions, but it faces tough opposition on the left and right

Mōrena and welcome to The Bulletin for Thursday, February 3, by Justin Giovannetti. Presented in partnership with Z Energy.

In today’s edition: Booster shot wait cut to three months; another look at Auckland rail; border reopening plan today; but first, a historic expansion of the country’s social welfare system.

Prime minister Jacinda Ardern and finance minister Grant Robertson. (Hagen Hopkins/Getty Images)

100,000 New Zealanders lose their jobs every year in what can be an expensive and scarring experience. It could be made a little easier. The government has detailed its flagship programme to close a yawning gap in the country’s social security system: a new unemployment insurance scheme to help workers who are laid off or face a long-term disability. The Spinoff’s live updates covered what the finance minister said he hopes is “an enduring solution” to providing workers with more economic security. The idea was first unveiled last year for the unemployed, but has now been extended to cover health conditions and disabilities. According to Politik (paywalled), it’s the most significant social programme proposed since accident compensation in the 1960s.

It’s a major change to New Zealand’s approach to welfare. As RNZ reports, workers will get to claim up to 80% of their former income for seven months under the programme, which will be administered by the ACC. The system goes up to an earnings cap of $130,911, which would a worker at that level about $1,600 weekly in unemployment. The first month will be paid directly by the former employer, as a disincentive to ensure they don’t try to misuse the new system. Officially called the income insurance scheme, it’s expected to cost $3.54 billion annually, split between job losses and health claims. Existing supports like the dole, pension and the accommodation supplement won’t be impacted.

Income insurance might not be an easy sell. New Zealand is one of the few countries without a similar system and two-thirds of unemployed workers get no benefit right now. But unemployment hit a 35-year low of 3.2% yesterday and inflation is at its highest point in a generation. As Tom Pullar-Strecker writes for Stuff, that makes this is a “brave” time to propose a new tax on incomes to help the unemployed.

Despite that, the policy was hammered out by the government, the Council of Trade Unions and Business NZ. All three have reasons to back the programme, although some debate over its final form remains. Public consultations will now last until April. For unions, the new scheme will provide a cushion for workers who lose their jobs. For businesses, it could mean increased productivity as the unemployed can wait longer for a job that more closely matches their skills. The current system often encourages people to take the first job they can find, which is bad for the economy in the long run.

By international standards, the scheme is generous. Especially compared to the cost. A new levy will be created to pay for the system, initially set at 1.39% of each paycheque, paid by both workers and employers. The few programmes that offer more money, or for longer, are often in Scandinavian countries that require payroll deductions that are three or four times higher. Some businesses told Stuff that the scheme is too expensive and they’d prefer that it only support people made redundant. Despite being one of the plan’s authors, Business NZ said it would back a more narrowly focused insurance scheme.

Is it a new tax? Call it a levy if you’d like, but it’s hard to argue that it isn’t technically a tax. The NZ Herald reports that National leader Christopher Luxon has said workers can’t afford to pay for the scheme along with rapidly increasing prices and the current welfare system is fit for purpose. That last bit is an opinion not shared by any other party in parliament. Act has said they support a form for unemployment insurance because the welfare system is broken, but this proposal is too expensive when inflation is running at 6%. It should be noted that the government’s proposal won’t take effect until the end of 2023 at the earliest, at which point most economists expect the current bout of inflation to have slowed considerably.

Moving towards a two-tier system. Criticism of the policy isn’t just from the right. If anything, some progressives are angrier. The Greens say they are worried that it marks the creation of a two-tiered system of support, where everyone gets more economic security, but some are left much more secure. MP Ricardo Menéndez March said the programme’s level of support should be based on people’s needs and not the size of their last paycheque. The Greens want the government to instead focus on comprehensive upgrades to the welfare system. The Child Poverty Action Group argued the plan is “likely to be regressive and would bake-in existing inequities” as Māori, women and people with disabilities are likely to get less when they find themselves unemployed.

Omicron means that, yet again, we at The Spinoff will be devoting significant resources to covering this enormous and complex story. If you value what we do, please consider becoming a member today. Every dollar donated is ring-fenced to support our journalism, and right now we need audience support more than ever.

Is your organisation keen to support The Spinoff? We would love to hear from you—contact us today to find out more about our organisation memberships.

The interval for booster shots has been cut to three months. In a race to get ahead of the omicron outbreak, the government wants to get booster shots out faster. According to RNZ, people who got their second dose of the Pfizer jab more than three months ago can get a booster from Friday. That means a million more people suddenly find themselves eligible for one of the best tools we have to reduce the severity of an omicron infection. The change is significant for Māori, who generally were in the group that got their jabs later. The government will next be getting advice on when to extend boosters to teenagers. There’s been no talk in the Ministry of Health yet around a fourth jab, despite some growing chatter overseas.

The Spinoff’s Covid data tracker has the latest figures.

Another look at the big Auckland light rail announcement. The deputy prime minister strolled into The Spinoff’s office at parliament yesterday and said with a grin: “A lot of announcements recently, right?” Yes. One of them is a proposal for the largest infrastructure project in the country’s history. Auckland’s tunnelled light rail plan was released on Friday and it’s time to circle back and look at it. The Greater Auckland blog has gone through the plan in close detail and raises some important questions. The NZ Herald (paywalled) has discovered that the $14.6 billion price tag is a rough estimate and could actually be as high as $24 billion, or $1 billion per kilometre.

Why we should tone down the rhetoric on the border. The Charlotte Bellis story over the past few days has not brought out the best in some New Zealanders. It’s been best to stay off social media. Newsroom’s Marc Daalder writes from MIQ in Christchurch that rhetoric on both sides has been unnecessarily callous and a reality check is needed. New Zealand’s hard border has done heavy lifting as the country’s main line of defence for two years, it has saved thousands of lives. It’s also been two years. New Zealanders here and overseas have made incredible sacrifices in forgoing so many important parts of life to maintain that hard border. MIQ is imperfect, perhaps deeply so, scrutiny and criticism has made it better. It’s time to recognise that another million New Zealanders overseas were part of the team of six million.

The prime minister is likely to acknowledge as much later today, when she announces plans to finally end MIQ for most arrivals in the coming weeks. The NZ Herald reports the border will reopen on February 27 for New Zealanders in Australia, with the rest of the world to follow in mid-March. Then we can only smile at the thought of all the grandparents who get to hold their grandchildren for the first time and families reunited.

A special offer from Bernard Hickey

I’m Bernard Hickey, a journalist and host of the weekly When the Facts Change podcast for The Spinoff Podcast Network. I was one of the first subscribers to The Bulletin and have read it avidly ever since.

I also produce my own daily Substack newsletter for subscribers, where I dive behind the news around housing, the economy, climate change and child poverty. It’s called The Kākā. I’m thrilled to be able to offer an introductory deal to readers of The Bulletin: 50% off for the first year’s subscription. There’s also a free weekly version, if you’d like to try before you sign up. Subscribe and support my journalism here.

State of emergency declared in Buller, evacuations due to heavy rains. The west coast is getting hammered by wet weather, The Press reports. Sandbags are being filled and residents are on alert that they might need to evacuate today. There’s a feeling of déjà vu after flooding twice last year, with over 200 homes inundated in Westport during the worst of times. The rain is expected to continue for days and power cuts are likely. To get a scale of what’s coming, MetService has illustrated the extreme rain hitting the South Island.

New Zealand’s first NFT auction sells two digital images of C.F. Goldie for $127,000. Non-fungible tokens have now broken into the New Zealand market, following the sale of rights to two pieces of art. The physical copies of the art were sold as well in the auction. NFTs use blockchain to show the ownership of something. According to RNZ, the two images, which show the artist in his studio and at an easel, sold well above market expectations. They were expected to fetch about $5,000 to $8,000 each. Unlike some sales overseas transacted in Bitcoin, the New Zealand buyers paid with dollars.

Got some feedback about The Bulletin, or anything in the news?

Get in touch with me at thebulletin@thespinoff.co.nz

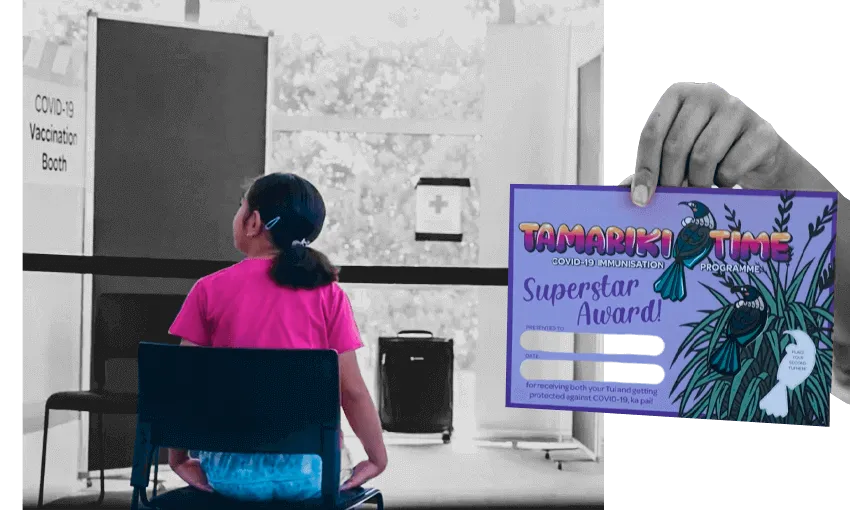

DHBs have launched initiatives targeting tamariki Māori. (Image: Tina Tiller)

Right now on The Spinoff: Toby Manhire speaks with a paediatrician who says it isn’t too early to demand an explanation for the lagging vaccination rate of Māori children. Shanti Mathias reports on New Zealanders learning the languages of their ancestors through apps. Sela Jane Hopgood discovers the story behind the “Vote Efeso Collins” jingle. Dylan Reeve explains the privacy implications of every trip you take with Uber. Tara Ward reviews the new Breakfast set and finds it an absolute delight. However there was one casualty and they really need to bring back the weather broom.

All six Super Rugby teams moving to Queenstown for the next month, or more, to ride out omicron. The first season of Super Rugby Pacific is kicking off in two weeks and all of New Zealand’s games will be played in the south, with New Zealand Rugby telling RNZ that all local teams are moving to Queenstown. The plan is for the teams to exist in bubbles that are subject to regular rapid testing. The Blues, Hurricanes, Moana Pasifika and Chiefs will fly to the city on charter flights in the coming days, while the Crusaders and Highlanders will take buses over the weekend. Day games will be played at the Wakatipu Rugby Club in Queenstown while night matches will be in Invercargill.