Victory declared in war against the 'inflation beast'

But what stopped the consumer price index from dropping even lower?

Mōrena, and welcome to The Bulletin for Thursday, October 17.

In today’s edition: Reports that an intervention at Wellington Council is more likely than not, Prince William makes Jacinda Ardern a dame, and could the Darleen Tana saga finally be coming to an end? But first, pop the (cheap) champagne: there is good news in the battle against inflation.

Inflation within target rate

The war on inflation is over and the cost of living crisis is nearing its end, declared Kiwibank’s economists yesterday afternoon. The latest figures from Stats NZ, reported the Herald’s business editor-at-large Liam Dann, showed inflation falling in the September quarter down to its lowest rate in more than three years at 2.2% – outpacing expectations and well within the target rate of 1-3%. The annual increase reported in the June quarter was a little over 3%.

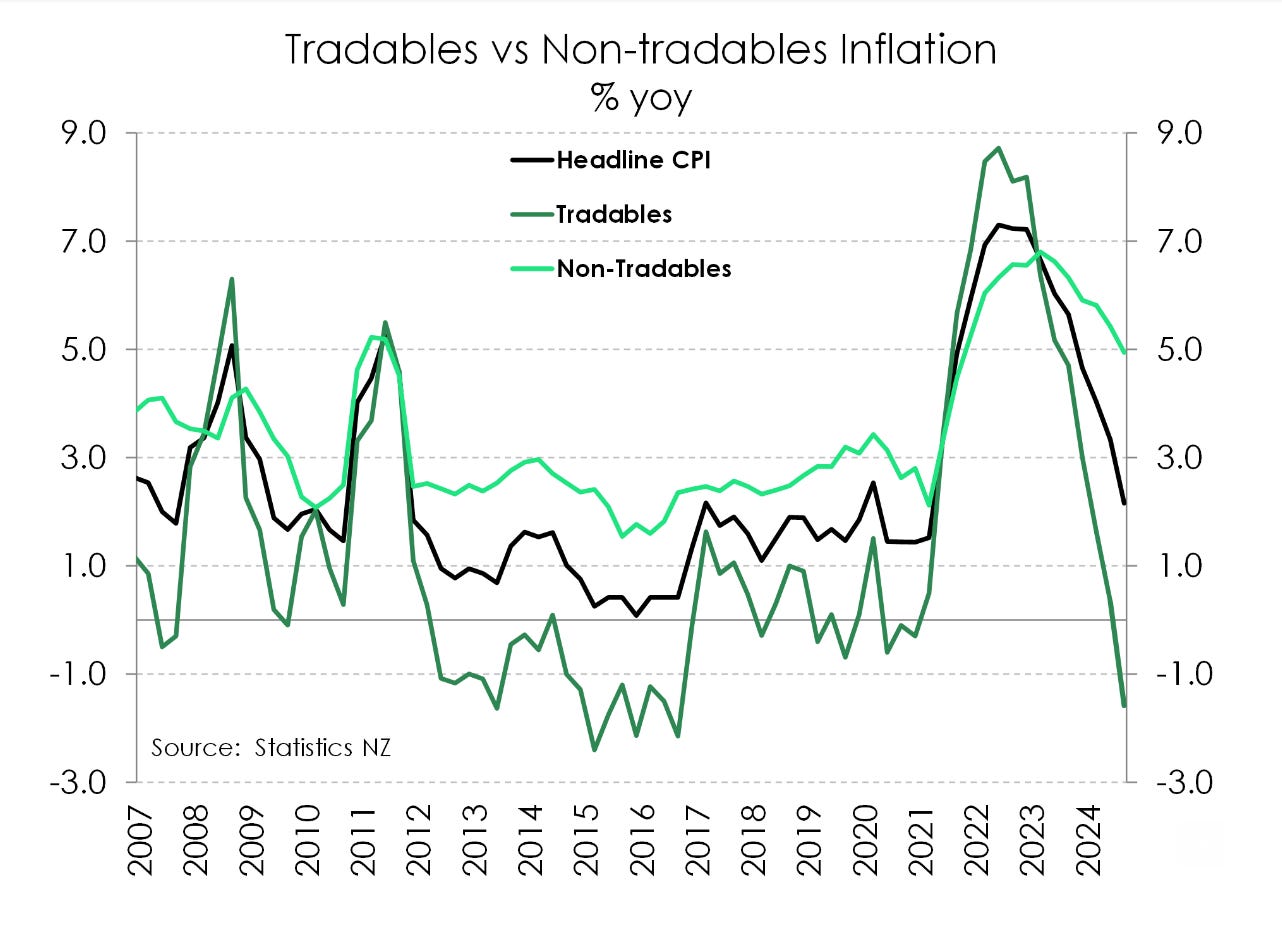

As the graph below shows, imported (or tradeable) inflation fell 1.6% for the year, while domestic or non-tradeable inflation was still elevated at 4.9%.

In July, when it appeared inflation was finally on the decline, The Spinoff’s Shanti Mathias and Joel MacManus provided some excellent advice on how to host an “inflation is over” party (confetti balloons included). Maybe now it’s time to finally crack out the (cheap) champagne.

How the government reacted – and why

Leading off the general debate in parliament yesterday afternoon, finance minister Nicola Willis celebrated the result and declared that the “National-led government broke the back of the inflation beast”. A dramatic turn of phrase, but given the fact the government had pledged to have the economy turn a corner, possibly justified. “We have delivered the tax relief that the National Party campaigned on, we have delivered lower inflation, and we have delivered dropping interest rates,” continued Willis.

It’s worth remembering that while times may still be tough, the coalition government will be banking on economic improvements coming further into focus in time for the next election. People won’t necessarily cast their vote while looking in the rearview mirror, especially when it comes to their back pockets. As noted by The Spinoff’s Toby Manhire this week: “Assuming an economic recovery is imminent, the harvest is there to be reaped. And it could well pan out that way, as long as other factors, whether in social cohesion, say, or rising unemployment, don’t drown it out.”

The opposition, reported The Post, opted to tinge yesterday’s announcement with some concerns – namely the large numbers of New Zealanders choosing to leave the country. “Nicola Willis wants to take credit for getting inflation down. She should take responsibility for these statistics as well,” said Labour finance spokesperson Barbara Edmonds.

What will it mean for interest rates?

There could be further good news on the horizon. The Reserve Bank recently slashed the official cash rate by a larger than usual 50 basis points, and all signs point to it doing the same at least once more. BusinessDesk’s Pattrick Smellie (paywalled) reported that bank economists were unanimous in picking that interest rates will be slashed by another 50 points next month, bringing the official cash rate down to 4.25%.

But there is also some speculation the central bank could go a step further. Assistant Reserve Bank governor Karen Silk said she was tempted to “do a little jig” upon hearing that inflation had fallen, reported The Post. She wouldn’t say whether that meant an even bigger 75 basis point cut could come next month, but also didn’t rule it out. “We've still got a lot of information to absorb between now and then,” she said.

While the main banks expect the next cut to mirror this month’s, some economists – such as Infometrics’ Gareth Kiernan – say a 0.75 is possible. “Further weakness in other data over the next few weeks could reinforce the need for a bigger cut to get interest rates back towards neutral faster, so a 75 point cut remains a strong possibility,” he told Stuff. By Wednesday afternoon, reported Interest’s David Hargreaves, the market was nearly split on whether 75 point cut was likely.

It’s not all rosy

The headline figure is of course excellent news. But buried beneath it, there were several inflation drivers that will be of concern to some. Rent prices were up 4.5% annually, which as BusinessDesk’s Gregor Thompson noted (paywalled) accounted for a fifth of the 2.2% annual inflation rise. In Canterbury, rents rose by 6.6%. There were also other “black spots” in the inflation data, reported The Post’s Tom Pullar-Strecker, with council rates up 12.2% across the country. Stats NZ’s Nicola Growden said this was the largest increase since the 1990s and was also spread unevenly across the country. Government moves to reintroduce fees on prescriptions and to cut tobacco excise also contributed to inflation.

Liam Dann at the Herald (paywalled), always one to add a healthy dose of realism into any discussion about the economy, noted that other countries are at risk of overshooting the 2% target and entering the deflation spiral. And, he said, domestically driven inflation remaining around 5% will mean not everything feels back to normal just yet. “That’s the problem with popping the champagne and declaring the war on inflation over. Many consumers will still feel they are battling inflation because of ongoing price rises for things like council rates, insurance, and any number of service sector costs,” he wrote.

Join our community of supporters

"I like that it feels like chipping in for a good cause, rather than paying for a subscription." – Kimberley, Spinoff member.

Whether you read, listen to or watch our mahi, you can support us to do more by donating today or signing up to become a member. Already a member? Ka nui te mihi, your support means the world to us.

Wellington mayor to meet with Simeon Brown

Tory Whanau will meet with local government minister Simeon Brown this morning as the government threatens to intervene in the Wellington City Council. As we talked about yesterday, options on the table include replacing the council with commissioners or calling an early election, though it would appear the option favoured by the government is to send in a Crown observer. Stuff’s Jenna Lynch reports that, according to a source, intervention in Wellington Council is more likely than not. A Crown observer is seen as the most “democratic option” and it’s hoped it might compel the council to behave, said Lynch.

Writing for The Post, Luke Malpass argues that sending in an observer would be the right move. “If an observer is sent in, the council must cooperate and comply,” Malpass writes. “It would be a good middle option for the government. The duly elected council remains in place – but the government would be basically sending in a supercharged auditor, likely a real hard head who can come to grips with what is going on.”

Jacinda Ardern made a dame: ‘A huge honour’

Former prime minister Jacinda Ardern has been made a dame during a ceremony at Windsor Castle presided over by Prince William. The pair have got to know each other through their work with the Prince’s Earthshot Prize and Ardern said it was “particularly special” to be recognised by the Royal.

In a post on Instagram by the Prince and Princess of Wales, Ardern described being made a dame as a “huge honour” and an acknowledgement of her family and “everyone who supported me, and that includes a very large number of New Zealanders”.

Since leaving office at the start of last year, Ardern has been involved with charity work, writing a book and teaching. She said it was about “supporting others who want to practise empathetic leadership”.

She added: “I would sum it up with sort of just trying to spread a little kindness in the world.”

Next week: Our most ambitious pop culture project ever

For over a decade, The Spinoff has been passionate about local television. Next week we launch our most ambitious project yet: a definitive list and ranking of the Top 100 New Zealand television shows of the 21st century.

A panel of seasoned critics and our in-house couch potatoes have made their calls. The countdown to number one starts Monday, October 21.

Subscribe to Rec Room now to get the rankings delivered directly to you as soon as they're live each day.

Click and Collect

ACC has reported a $7.2 billion annual deficit for the year to the end of June.

About 1,000 insurance claims have been lodged following this month’s deluge in Otago.

MediaWorks has confirmed a plan to disestablish some roles as part of a restructure that is understood to impact dozens of staff across the business.

British back in America’s Cup hunt as competition tightens to 4-2.

For Newsroom Pro subscribers, Fox Meyer reports on National MP Greg Fleming who said during the election campaign he’d lie on the tracks to stop a controversial heavy rail project. Now that project is on his own government’s fast-track list. (Paywalled)

George Driver looks at the rules which allow medicinal cannabis companies to own the clinics where their product is prescribed. Happy Niue language week, writes Madeleine Chapman, the Samoans are fighting again. Alex Casey power ranks the sixth and final week of Celebrity Treasure Island 2024. Gavin Bishop describes becoming 'besotted' with Middle-Earth in The Spinoff Books Confessional. Gráinne Patterson explains how people pleasing is hard for individuals - but also for the people around them. Toby Manhire lists all the things Christopher Luxon gets. The Spinoff Guide to Life presents some tips on sending a text without being annoying.

That’s it for this morning, thanks for reading. See you back here tomorrow.

Want to get in touch? Join the conversation in the Substack comments section below or via email at thebulletin@thespinoff.co.nz if you have any feedback on today’s top stories (or anything else in the news).

If you liked what you read today, share The Bulletin with friends, family and colleagues.

I guess the measure of our cost-of-living-crisis "nearing its end" is exceedingly relative, given the effects of lowered inflation are unlikely to be felt in people's pockets for several months, rents continue to rise, rising unemployment puts people in jeopardy, and this government's on-going harm to (non-wealthy) people has no end in sight!

> British back in America’s Cup hunt as competition tightens to 4-2.

Wow... is there a way you could write a CTA without revealing the results?